The Chancellor, Rachel Reeves, has confirmed that the UK is moving toward a one-day settlement cycle (T+1) for cash securities—a change aimed at reducing risks and increasing market efficiency. Accepting all recommendations from the UK Accelerated Settlement Taskforce (AST) Technical Group, the target date is set for October 11, 2027.

This seismic shift focuses on streamlining post-trade operations and has been in operation in the US since its introduction on May 28, 2024. However, T+1 is not without its operational challenges that need to be overcome.

The FCA recommends that firms should determine now what is required to move to a T+1 settlement cycle and plan early to deliver this transition. This can include budget considerations, operational systems changes and testing, agreements with third party providers and counterparty arrangements. How can firms optimise operations to meet this faster settlement cycle?

Operational Pressures and the Need for Faster Resolution

The T+1 transition in the UK will primarily impact cash equities, GB ISIN fixed income, and certain ETPs. This new settlement cycle compresses the time available for critical post-trade activities, such as trade confirmation, reconciliation, and exception handling. This places added pressure on middle office, back office, and treasury functions. For example, faster query resolution is essential to maintain cash management, ensuring that funds are available to meet settlement obligations and that liquidity forecasts remain accurate.

Failing to meet T+1 requirements can lead to severe consequences, including settlement failures that trigger penalties and higher funding costs due to liquidity gaps. Additionally, inadequate automation increases operational overload, erodes customer trust through delayed responses, and leaves firms vulnerable to market volatility and counterparty defaults.

How YUDOmail Helps Firms Meet T+1 Requirements

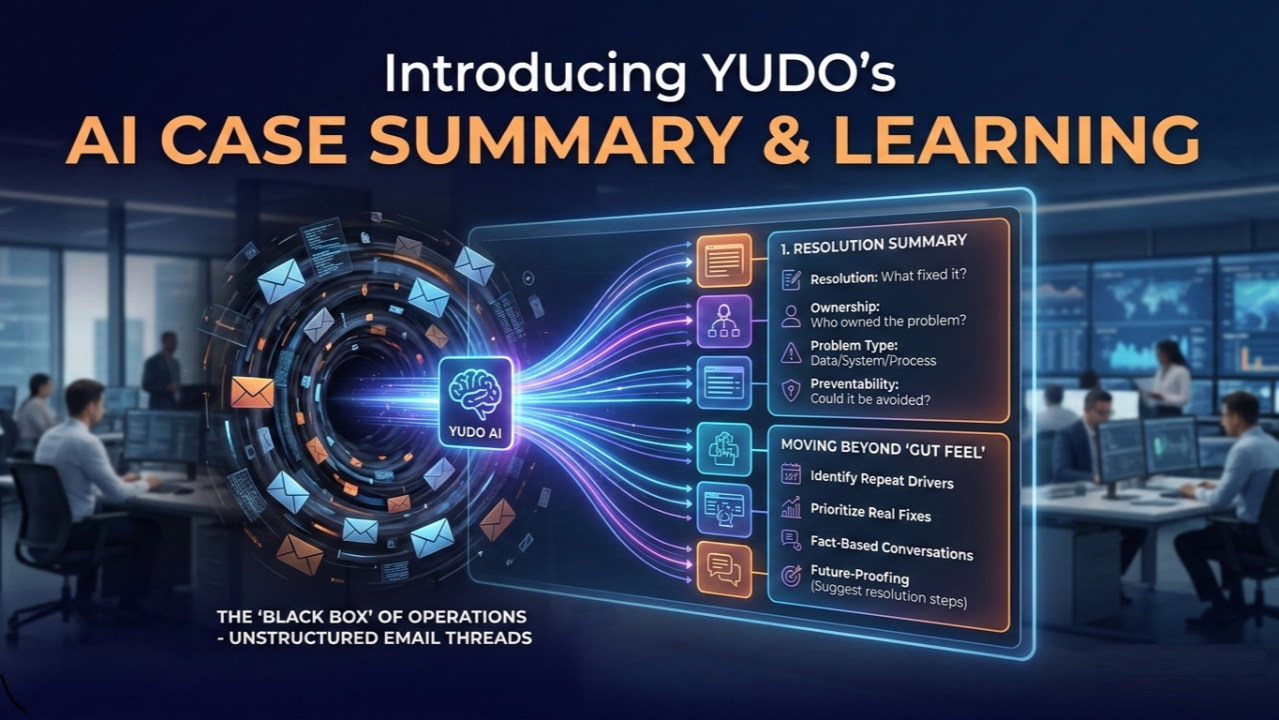

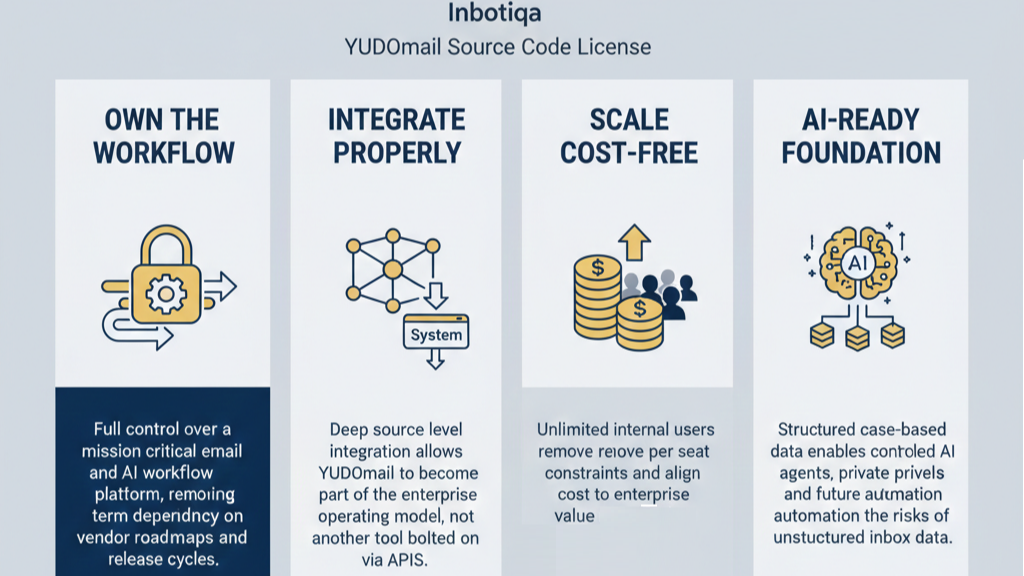

With faster deadlines and turnaround times, advanced workflow management systems can play a key role in helping teams deliver on T+1 requirements. YUDOmail offers several features that assist financial institutions in adapting to T+1 requirements:

- Rules-Enabled Assignment, Enrichment & Case Closure: Automates routine tasks, reducing inbox administrative load.

- Consolidation of Related Mails: Groups all emails related to a specific query into a single case, streamlining communication.

- Configurable SLAs & Priority Levels: Provides visibility into pending tasks and helps manage email risk effectively.

- Intuitive UI: Simplifies the management of complex workflows.

- Full Audit Trail: Increases user accountability by recording every action taken.

- Insightful Reporting: Offers real-time data on email volumes and workflow performance, highlighting opportunities for further automation.

- Customer Service & Exception Handling: Flags exceptions for follow-up, ensuring issues are tracked and enabling teams to maintain service quality with full accountability.

By integrating with advanced Large Language Models (LLMs) for data analysis, YUDOmail further accelerates query resolution and provides deep insights that support quicker decision-making. This combination of features helps institutions cope with the tighter deadlines imposed by T+1, ensuring that post-trade operations and cash management functions remain robust.

The Future is T+1

The shorter T+1 settlement cycle demands faster processing and greater automation across middle office, back office and treasury functions. Technologies like YUDOmail, with its automated assignment, case consolidation, configurable SLAs and robust reporting, offer practical tools to address these challenges, delivering enhanced accountability and reduced query resolution times.

Understanding and preparing for the T+1 transition is a crucial step for financial institutions as they adapt to a faster, more efficient market environment.

Find out how you can get ahead of the T+1 transition with YUDOmail. Contact the team for a demo at demo@inbotiqa.com.